are campaign contributions tax deductible in 2020

You dont have to take them as an itemized deduction for medical expenses which is advantageous because itemized medical deductions are limited to expenses paid in excess of 75 of your adjusted gross income in tax year 2021. CNS News -- When Joe Biden started his term as president in January 2021 the average price of a gallon of regular gasoline was 225.

Renta And Heritage Campaign 2019 Mm Tax Accountants

A 501c3 organization is a United States corporation trust unincorporated association or other type of organization exempt from federal income tax under section 501c3 of Title 26 of the United States CodeIt is one of the 29 types of 501c nonprofit organizations in the US.

. Updated tax brackets for the year 2020. Today the average for a gallon of regular is 501. The Federal Election Campaign Act limits contributions to 2900 per election for the 2021-2022 federal election cycle.

While taxpayers in the bottom four quintiles would see an increase in after-tax incomes in 2021 primarily due to the temporary CTC expansion by 2030 the plan would lead to lower. For example if you are a single person the lowest possible tax rate of 10 percent is applied to the first 9525 of your income in 2020. Help Charity Navigator rate more organizations with your tax-deductible donation.

NW IR-6526 Washington DC 20224. If the corporation is using the California computation method to compute the net income enter the difference of column c and column d on Schedule F line 17. A Statement on Guaranteeing Civil Rights.

Self-Employed defined as a return with a Schedule CC-EZ tax form. Theres financial incentive for Americans to give generously to charity. The next portion of your income is taxed at the next tax bracket of 12 percent.

Based upon IRS Sole Proprietor data as of 2020 tax year 2019. As a society we give nearly 2 of our personal income to charities and nonprofit organizations. Enter the nature of the tax the taxing authority the total tax and the amount of the tax that is not deductible for California purposes on Form 100 Side 4 Schedule A.

For tax purposes the law classifies charities and nonprofits according to their mission. Your bracket shows you the tax rate that you will pay for each portion of your income. Contributions to an HSA are tax-deductible on your Form 1040 tax return as an adjustment to income.

You can send us comments through IRSgovFormCommentsOr you can write to the Internal Revenue Service Tax Forms and Publications 1111 Constitution Ave. We welcome your comments about this publication and suggestions for future editions. Starting with 2020 returns taxpayers can claim up to 300 of cash contributions as an above-the-line deduction on Form 1040.

Bidens tax plan is estimated to raise about 333 trillion over the next decade on a conventional basis and 278 trillion after accounting for the reduction in the size of the US. When you donate to a 501c3 public charity including Fidelity Charitable you are able to take an income tax charitable deductionThe purpose of charitable tax deductions are to reduce your taxable income and your tax billand in this case improving the world while youre at it. To deduct more than that the business owner has to itemize deductions on Schedule A attached to Form 1040.

Donate Now Other Ways To Give 0. But are political contributions tax-deductible. During his campaign for president in 2020 Biden said that if elected there would be no ore drilling for oil period ends.

RMDs extended to August 31 2020. However there is a common misconception that all nonprofits are qualifying charitable organizations - but that isnt always the case. Charity Navigator Convenes Consultative Council of Nonprofit Leaders.

501c3 tax-exemptions apply to entities that are organized and operated exclusively for religious. One important point to note is. Child and dependent care expenses.

But are political contributions tax-deductible. When elections start picking up you might be looking to donate or work with your campaign of choice. Gifts to a non-qualified charity or nonprofit.

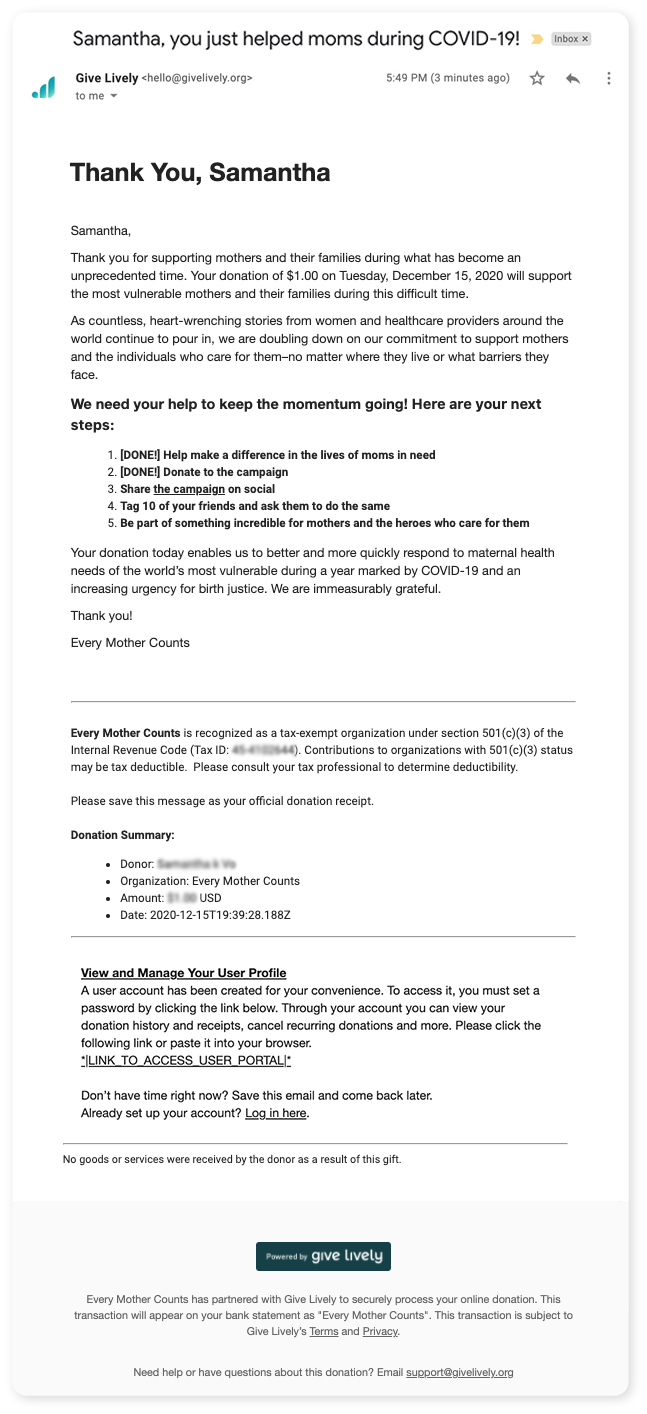

Give Lively Faq Are Donations Made Through Give Lively Tax Deductible

Top 4 Money In Politics Takeaways From The 2020 Election Cycle Institute For Free Speech

How The 3 Campaign Contribution Check Box On Your Tax Form Works Marketplace

Charity Navigator Top 5 Things To Remember When Making Political Donations

Are Political Contributions Tax Deductible Smartasset

Are Political Contributions Tax Deductible

Are Political Donations Tax Deductible

Are Campaign Contributions Tax Deductible

Are Political Contributions Tax Deductible Smartasset

Fbi Probe Spurs Questioning Of Money In Anaheim Politics Campaign Finance Reform

Are Political Donations Tax Deductible Credit Karma

Are Political Contributions Tax Deductible H R Block

How The 3 Campaign Contribution Check Box On Your Tax Form Works Marketplace

A National Tax On Campaign Contributions And Lobbying Equality Of Opportunity Political Podcast

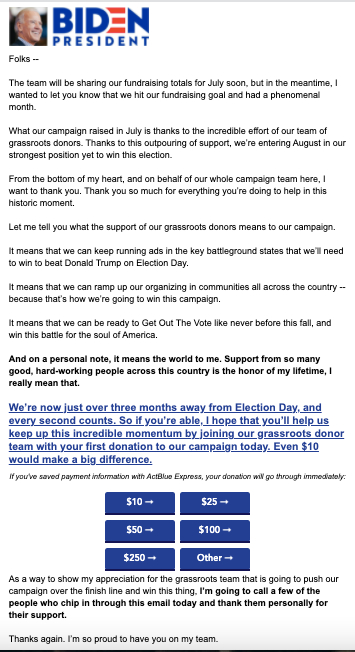

The Secret To Writing Political Donation Letters With Samples

Are My Donations Tax Deductible Actblue Support

Are Political Contributions Tax Deductible H R Block